If you own a medical practice or are in charge of running one, you must have faced challenges that are beyond your control. There is no doubt about it, the challenges are not only increasing but are also becoming more and more complex with each passing year. Want facts? Well, based on data from multiple reports, hospital margins significantly decreased in the last quarter of 2024, dipping from 4.9% to 4.7%.

This might not sound much, but it amounts to billions of dollars when summed up for hospitals across the country. Picture this: Your practice is busier than ever, patient satisfaction scores are up, and your clinical team is delivering exceptional care. Yet somehow, cash flow remains tight, and accounts receivable keep growing.

If this sounds familiar, don’t worry. Almost all practices, especially the small ones, face this. That’s why it is imperative for practices to boost their revenue cycle management. But how? Well, that’s what we are going to find out in this blog. So, let’s start.

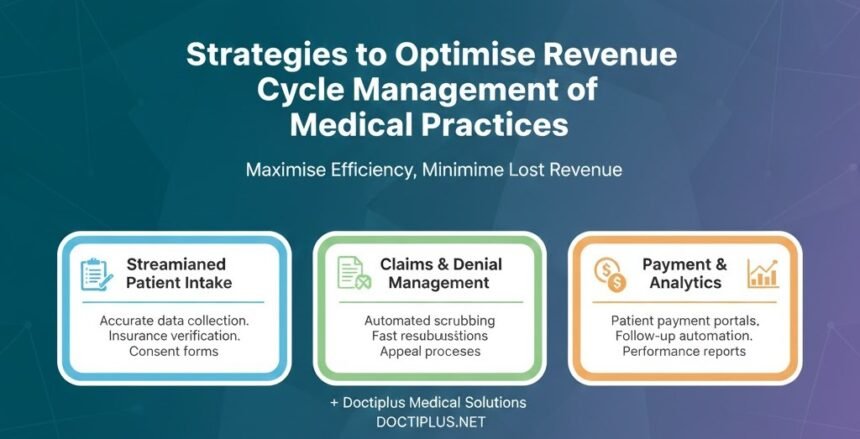

Key Strategies to Optimise RCM

Implement Front-End Revenue Cycle Processes

Everything starts with the front-end processes. So, it is logical to start improving from there. Your revenue cycle’s success is largely determined before the patient ever walks through the door. Front-end processes set the stage for everything that follows.

Begin with small steps. Make the patient registration process foolproof. Is it basic? Yet registration errors remain one of the top causes of claim denials. A missing middle initial, transposed digits in a date of birth, or outdated insurance information can send your claim into denial. Next, move on to insurance verification and eligibility screening processes.

Doing only this will significantly improve your claim’s first pass ratio. Here are some critical steps to consider:

- Confirm patient insurance coverage and benefits 2-3 days before their scheduled visit.

- Ensure the collection of precise patient demographic data at the time of scheduling.

- Establish and clearly communicate financial policies to all patients.

- Determine the patient’s out-of-pocket costs before the service is provided, where feasible.

Improve Coding and Documentation

Documentation is the key to revenue collection. Wondering how? Well, without proper documentation, the insurance companies reject the claim. This results in revenue loss and reduced cash flow. Do you know that most healthcare providers claim that 35% of all the claim denials they face originate from inaccurate patient identification or inaccurate/incomplete patient documentation?

Providers should:

- Conduct regular coding audits and provide targeted education

- Implement clinical documentation improvement (CDI) programs

- Stay current with coding updates and payer-specific requirements

- Consider speciality-specific coding resources for complex specialities

By improving the claim pass rates, healthcare providers can significantly improve their revenue collection and find and fix revenue leaks in the system.

Leverage Technology and Automation

The next most important thing that you can do to improve your revenue cycle management is to invest in better technology and software. This isn’t the 1900s anymore. If you are not using the latest technology, you are doomed to fail. Technology has transformed RCM from a paper-pushing nightmare into a streamlined, data-driven operation.

So, what should you invest in? Integrated EHR and billing systems should be your top priority. They eliminate the manual data entry that causes so many errors. When clinical documentation flows seamlessly into billing, you reduce mistakes and speed up the entire process.

Next, go for automated claim scrubbing tools. These tools are nothing short of incredible. They catch errors before submission. So, denials are guaranteed to be reduced. These systems check claims against thousands of payer-specific rules, identifying issues that would trigger denials. Practices using automated scrubbing typically see clean claim rates above 95%

Consider Strategic Outsourcing

The final and also the most beneficial step that you can take to improve your revenue cycle management is to outsource medical billing services to specialised third-party billing vendors. You are a healthcare provider, not a billing specialist.

Practices that outsource often save 30-40% in operational expenses compared to in-house billing. You eliminate salary, benefits, training costs, and software expenses. Plus, you free up your staff to focus on patient care rather than insurance hassles.

However, don’t fall victim to marketing traps. Most of these companies promise the world on their websites, but fail miserably in the real world. So, before selecting a partner, perform deep research on medical billing companies in your locality. Go for companies that offer:

- AR under 30 days

- 95% or higher clean claims rate

- Upto 95% collection ratio

- Denial rates between 5-10%

Final Word

Revenue cycle optimisation is an imperative nowadays, when financial burden is increasing for both large hospitals and small practices. To survive in the face of growing competition and inflation, healthcare providers must adapt.

In this blog, we outlined a handful of strategies that you can use to boost your revenue cycle management quickly. Remember, every dollar you recover through better RCM is a dollar that can be reinvested in patient care, staff development, or practice growth.